May 17, 2025 | Bitcoin $103K+ | Market Cap: $2T+

This week’s conversation with Matt Pines is one of the most important we’ve had all year. As Executive Director of the Bitcoin Policy Institute and a leading voice on U.S. geopolitical strategy, Matt explains how Bitcoin has moved from outsider asset to strategic chess piece in the new global order. What began as a meme—“Strategic Bitcoin Reserve”—is now an active directive inside the U.S. government.

We explore how America’s debt constraints are reshaping foreign policy, how the U.S. could quietly accumulate Bitcoin without ever announcing it, and why remonetization of hard assets—gold, Bitcoin, and beyond—is now inevitable. This episode ties together AI, bitbonds, UAPs, and the invisible levers of global capital like no other. The only question left: when does the gun on the table get picked up?

America’s Geopolitical Reset

The U.S. is shifting from global dominance to a more defined sphere of influence, prioritizing bilateral and regional alliances over globalist ideology.

Trump’s visit to Saudi Arabia and the broader GCC signals a push to align Gulf capital with U.S. strategic goals.

In exchange for AI chips, arms deals, and access to U.S. markets, Gulf states are being integrated into a new U.S.-led bloc that excludes China.

This is a redefinition of Pax Americana—no longer about ideals, but about power, supply chains, and economic leverage.

Technology, energy, and capital are the battlegrounds of this new “great game.”

This reset is happening not by choice, but because U.S. fiscal and diplomatic constraints require it.

The Treasury Trap and Hard Asset Remonetization

With over $9 trillion in U.S. debt maturing this year, the Treasury market has become a geopolitical pressure point.

The U.S. needs buyers for long-duration debt, but can’t rely solely on the Fed or organic market demand.

Instead, it may pressure allies—like Japan or Saudi Arabia—to absorb debt through strategic agreements or backdoor QE.

Financial repression is coming: someone has to take real losses on low-yield debt in a high-inflation world.

As confidence erodes, sovereigns are returning to hard assets. Gold is already remonetizing.

The U.S. may quietly favor Bitcoin as a reserve asset—it owns more BTC (est. 35–40%) than gold (8–10%), giving it asymmetric leverage.

Bitcoin as a Strategic Reserve Asset

The “Strategic Bitcoin Reserve” went from internet meme to official policy in under a year.

Included in Trump’s March executive order, agencies are now tasked with finding budget-neutral ways to acquire Bitcoin.

This could include oil and gas royalties, asset forfeitures, seized cartel funds, or reallocated gold reserves.

The ambiguity of “budget-neutral” is intentional—it gives the government flexibility to accumulate BTC without direct spending.

If remonetization of hard assets is inevitable, Bitcoin gives the U.S. a first-mover advantage over rivals like China and Russia.

The U.S. doesn’t need to announce accumulation. It can happen quietly—just like strategic oil reserves.

Bitbonds and the Reinvention of Sovereign Debt

Bitbonds are a proposed way to attach Bitcoin exposure to U.S. government debt—essentially combining hard asset upside with traditional fixed income.

This would allow the U.S. to issue lower-coupon debt by offering Bitcoin-linked upside to investors.

It could attract long-duration buyers (e.g., pension funds, sovereigns) without openly debasing the dollar.

Bitbonds would also serve as a stealth mechanism for filling the Strategic Bitcoin Reserve.

Instead of announcing “we’re buying BTC,” the U.S. could accumulate it through structured sovereign finance tools.

It’s not a Bitcoin standard—but it’s a Trojan horse for monetary realignment.

Strategic Capital in the Shadows: Tether, UAPs, and the Deep State's Bitcoin Bet

Beyond headlines, Bitcoin may already be entangled with U.S. strategic capital flows.

Tether, FTX, and other entities have long operated in financial gray zones—useful to intelligence-linked operations.

Matt argues that parts of the U.S. government have likely seen Bitcoin as a tool—not just an asset—for years.

From covert finance to energy infrastructure and UAP research, Bitcoin sits at the intersection of technology and statecraft.

The most compelling metaphor: Bitcoin is “Chekhov’s gun” on the geopolitical table—placed there, waiting to be picked up.

Whether via defense-aligned VCs or the Strategic Reserve, signs point to the state being quietly long Bitcoin.

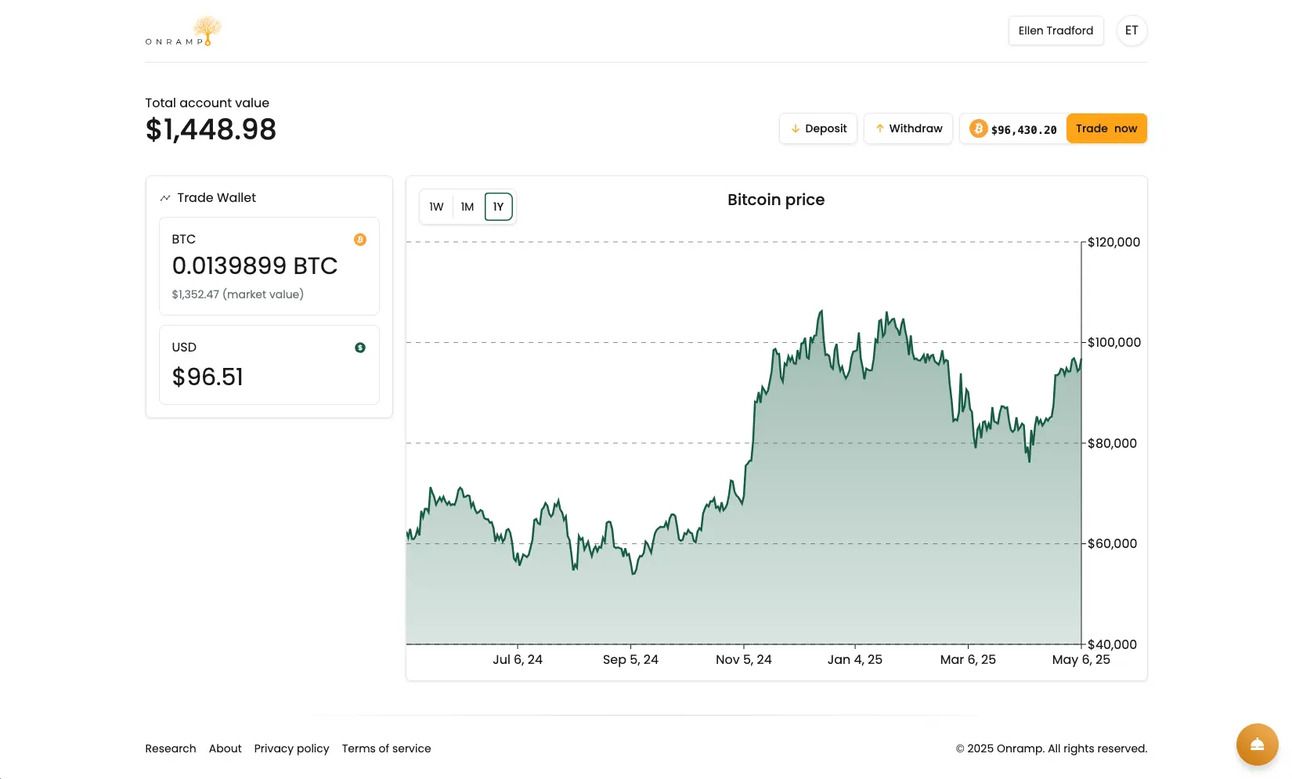

Onramp Client Dashboard - Set up an account & buy Bitcoin in minutes.

Onramp Trade launched last week.

A new account tier built to support clients from initial accumulation to long-term wealth stewardship.

As a reader of The Last Trade, use code TLT to unlock exclusive launch benefits:

Launch Promotions (Sign up by June 30):

🔸 Zero trading fees through September

🔸 50% off account fees ($25/month) through September

🔸 BTC referral rewards: $50 for Onramp Trade, $150 for MIC Vaults

At Onramp, we’re building the infrastructure for serious Bitcoin investors—secure, comprehensive, and purpose-built for long-term strategy.