May 24, 2025 | $110,000+ | $2.15T

Mark Yusko joins The Last Trade for our 100th episode, delivering a wide-ranging conversation that connects the dots between global bond market instability, the strategic rise of Bitcoin, and the emergence of MetaPlanet as Japan’s Bitcoin treasury pioneer.

From historical context on banking rails to current macro turbulence, Mark explains how monetary decay, capital flight, and institutional strategy are converging and why Bitcoin is increasingly seen as the world’s next base layer of money.

Whether you're tracking the Japanese yield curve shifts, U.S. fiscal deterioration, or the rise of sovereign and corporate Bitcoin adoption, this is a must-read for anyone thinking long-term about wealth preservation and opportunity in a multipolar world.

The MetaPlanet Moment: A Global Bitcoin Treasury Strategy

MetaPlanet is positioning itself as the “MicroStrategy of Asia,” seeing a 300x increase in market cap since adopting Bitcoin as its strategic treasury reserve asset in May 2024.

In Japan, corporate Bitcoin exposure via equity structures is taxed at 20% capital gains compared to 52% for direct ownership, creating significant tailwinds for treasury strategies.

CEO Simon Gerovich’s deep background in equity derivatives and sharp execution has been pivotal to MetaPlanet’s breakout.

Regulatory alignment helped accelerate their success. A pro-Bitcoin regulator was assigned to the firm, a rare stroke of luck that enabled early traction.

The firm’s rise signals a growing trend: Bitcoin treasury strategies are expanding globally, especially where tax and regulatory arbitrage exists.

Global Bond Breakdown: Japan as the Canary in the Coal Mine

Japan’s JGB market is cracking after four decades of yield suppression and aggressive money printing, which created a prolonged distortion in bond pricing and pushed the country’s debt-to-GDP ratio to 250%.

Under new leadership, the Bank of Japan ended its yield curve control policy—forcing a rapid unwinding of high-risk carry trades. It remains unclear when, or if, the BOJ will step back in to stabilize the market.

Massive institutional leverage—up to 100:1 in some sovereign bond markets—is now unwinding, placing upward pressure on yields across global fixed income markets.

A recent U.S. Treasury auction failed to attract sufficient demand, receiving no bids—an extremely rare event that highlights growing investor discomfort with the United States' deteriorating fiscal position.

Central banks may soon be forced to backstop sovereign debt markets by “printing money at the push of a button,” inflating away their currencies and triggering a repricing of scarce assets.

Bitcoin as Base Money: From Heresy to Hedge to Reserve Asset

Mark reframes Bitcoin not as a speculative bet, but as digital gold—the emerging base layer of money for a digitally connected, inflation-prone world.

Every four-year halving cycle adds a “zero” to Bitcoin’s price: from $100 → $1K → $10K → $100K → Mark projected $1M by 2029.

Bitcoin’s peer-to-peer structure and fixed supply make it the ultimate long-term reserve asset in a world of monetary manipulation. Mark calls it the “last trade”—a final allocation destination for capital fleeing fiat debasement, fiscal decay, and declining trust in sovereign credit.

The rise of Bitcoin treasury strategies at MetaPlanet, MicroStrategy, and others signals a shift in corporate capital management and balance sheet thinking.

As more institutions and individuals adopt Bitcoin with a long-term horizon, it transitions from a traded asset to a saved one—reducing sell pressure and reinforcing its monetary role.

U.S.–China–BRICS: Capital Flight and the Dollar Endgame

The global monetary system is fracturing, and capital is fleeing dollar-linked assets due to rising geopolitical tensions and worsening U.S. fiscal conditions.

China and BRICS nations are rapidly accumulating gold and reducing their reliance on U.S. Treasuries yet Bitcoin may ultimately leapfrog gold as the neutral reserve asset of choice, offering the U.S. a unique opportunity to align early with the next monetary standard.

The reintroduction of tariffs under U.S. policy mirrors prior economic regimes—most notably 1930 and 1980s protectionism—both of which contributed to recessionary outcomes. Investors are watching closely to see if rising trade barriers signal intentional economic deceleration to justify lower interest rates.

The U.S. still has a window to embrace Bitcoin strategically through stablecoin innovation, regulatory clarity, and public-private infrastructure to maintain dollar influence in digital capital markets.

As BRICS countries develop alternative settlement systems, such as gold-backed trade mechanisms and cross-border CBDCs, Bitcoin offers a parallel path for frictionless, non-sovereign value transfer outside the dollar system.

The Digital Rails Revolution: Stablecoins, Infrastructure, and Bitcoin’s Distribution Advantage

Mark frames stablecoins not CBDCs as the most promising evolution of global payment infrastructure, enabling real-time, borderless value transfer without surveillance.

USD-backed stablecoins are emerging as a bridge between legacy finance and crypto-native ecosystems—powering remittances, dollar dominance, and stable liquidity.

The Bitcoin infrastructure stack custody, UX, compliance, and platform security will define who leads the next wave of adoption.

Firms that offer simplicity without compromising sovereignty will be the ones that help users exit TradFi safely and confidently.

In this infrastructure race, Bitcoin is the foundational protocol but stablecoins and custody providers are the roads and ramps that determine how fast capital flows in.

Quote of the week

"The miracle of Bitcoin isn’t going from $10K to $100K—it’s going from $0.0003 to $1. That it caught on is the miracle." - Mark Yusko

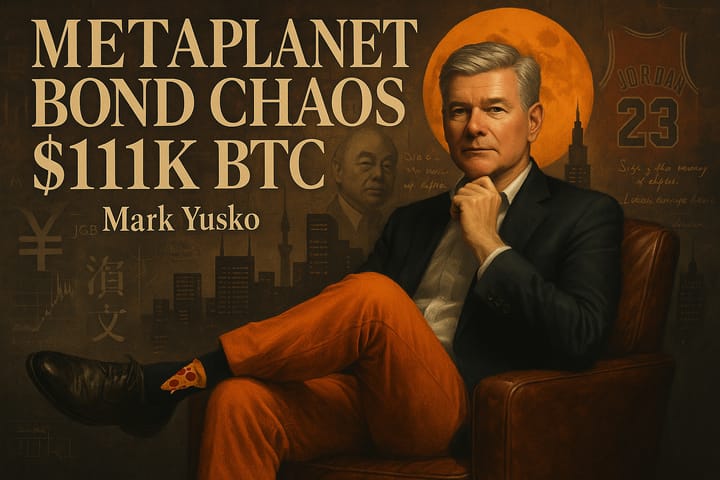

Onramp Client Dashboard - Set up an account & buy Bitcoin in minutes.

Onramp Trade launched this month.

A new account tier built to support clients from initial accumulation to long-term wealth stewardship.

As a reader of The Last Trade, use code TLT to unlock exclusive launch benefits:

Launch Promotions (Sign up by June 30):

🔸 Zero trading fees through September

🔸 50% off account fees ($25/month) through September

🔸 BTC referral rewards: $50 for Onramp Trade, $150 for MIC Vaults

At Onramp, we’re building the infrastructure for serious Bitcoin investors—secure, comprehensive, and purpose-built for long-term strategy.