May 31, 2025 | $105,000+ | $2.15T

Bitcoin 2025 wasn’t just another conference; it marked a turning point on the global stage. When Trump appeared at Bitcoin Nashville in 2024, many dismissed it as campaign theatrics.

But this year, the sitting Vice President JD Vance, multiple cabinet members, and representatives from across the U.S. on both sides of the aisle joined 35,000 attendees in Las Vegas, underscoring Bitcoin’s rapid ascent from fringe to front and center.

In this episode, we explore the evolving strategies of nations, corporations, and capital allocators. From Pakistan’s announcement of a government-backed Bitcoin reserve to PSG’s treasury strategy and Square’s rollout of Lightning integration across 4M+ merchants, Bitcoin adoption is accelerating on every front, as both a store of value and a medium of exchange.

We also discuss stretched equity valuations, the broken housing market, and the deteriorating fiscal position of the United States, all of which reinforce the Bitcoin thesis not only for individuals seeking wealth preservation but increasingly for governments facing insurmountable debt levels.

From Fringe to Front and Center: Institutional Involvement Ramping Up

Pakistan announced plans for a strategic Bitcoin reserve and increased energy investment for mining and data centers.

NYC Mayor Eric Adams voiced support for BitBonds and Bitcoin, a sharp turn from the city’s traditionally hostile stance, signaling Bitcoin’s growing appeal as an economic development lever.

Vice President Vance cited 50 million Americans with crypto exposure and predicted that number will double. Our view: how many have meaningful allocations? With only 35,000 in attendance, it's clear we’re still early.

Bipartisan interest is accelerating. Multiple states and federal officials are pushing Bitcoin legislation, now framing it as strategic, not partisan.

Trump’s inner circle, including Eric Trump and Donald Trump Jr., is directly involved with Bitcoin firms like American Bitcoin and MetaPlanet. Meanwhile, Vivek Ramaswamy is publicly championing Bitcoin as the new financial hurdle rate.

Corporate Bitcoin Treasuries Are Here, But Some Lack Conviction

Gamestop announced a $500M Bitcoin purchase, but Ryan Cohen’s four-minute video lacked strategic clarity or transparency, leaving the market underwhelmed and uncertain.

PSG, one of the world’s largest football clubs (500M fans, 80% under age 34), announced a Bitcoin treasury allocation and the launch of PSG Labs to fund digital asset innovation.

Steak & Shake now accepts Bitcoin payments at over 450 locations across the U.S., a major step toward Bitcoin as both a store of value and a payment rail.

Institutions Are Here and They’re Learning in Real Time

“Every capital allocator is in Vegas,” Tim reported. Banks, VCs, and asset managers were actively pitching deals and reviewing term sheets in private suites.

Executives now travel with private security due to real-world threats tied to their public association with Bitcoin and their Bitcoin holdings, revealing Bitcoin’s new status as a high-stakes asset and a need for more robust solutions.

Many institutions are deploying capital without fully understanding Bitcoin custody, inheritance risk, or financial services, highlighting the need for education as adoption accelerates and potentially posing risks down the line.

Firms like Strive are pioneering alpha strategies using Bitcoin across litigation finance, distressed asset acquisition, and capital markets.

Lightning Network, Payments, and Yield: It’s All Happening

Cash App’s merchant rail is a Trojan horse. Most of the 4M+ Square merchants won’t realize they’re accepting Bitcoin, but they’ll benefit from lower fees, paving the way for mass adoption without education friction.

Lightning routing node yield (~9.7% APR) beats most TradFi and DeFi benchmarks, with no leverage, smart contract, or counterparty risk, a new base layer of yield.

This is native, non-leveraged yield; proof that Bitcoin payments infrastructure can scale and reward liquidity providers.

Market Valuations, Housing Prices, and Fiscal Uncertainty

The U.S. must refinance over $10 trillion in debt this year, with 30-year yields hitting 5.1%, the highest since 2007, amid tariff uncertainty and a U.S. government credit downgrade.

Equity markets remain elevated, but much of that is driven by fiat debasement. Investors are turning to Bitcoin, real estate, and alternative stores of value, keeping valuations inflated well beyond historical norms.

Home ownership has never been more out of reach. The median age of homebuyers in the U.S. is now 56, up from 45 just three years ago. It’s a clear sign of a broken system and why Bitcoin matters for Millennials and Gen Z.

With 401(k) restrictions loosening, over $8 trillion in retirement assets could soon gain access to Bitcoin through ETFs and structured vehicles.

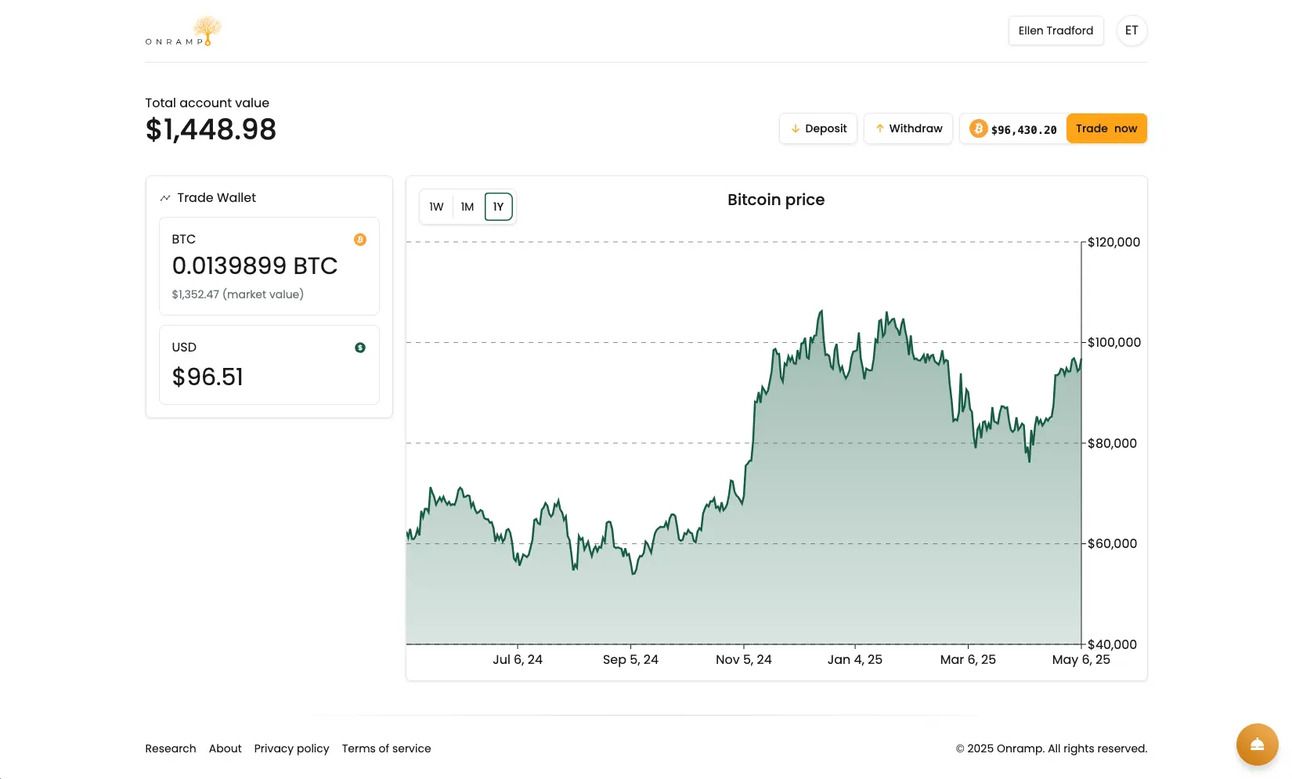

Onramp Client Dashboard - Set up an account & buy Bitcoin in minutes.

Onramp Trade launched this month.

A new account tier built to support clients from initial accumulation to long-term wealth stewardship.

As a reader of The Last Trade, use code TLT to unlock exclusive launch benefits:

Launch Promotions (Sign up by June 30):

🔸 Zero trading fees through September

🔸 50% off account fees ($25/month) through September

🔸 BTC referral rewards: $50 for Onramp Trade, $150 for MIC Vaults

At Onramp, we’re building the infrastructure for serious Bitcoin investors—secure, comprehensive, and purpose-built for long-term strategy.