May 10, 2025 | Bitcoin $100K+ | Market Cap: $2T+

This week, Bitcoin crossed back above $100,000 and reclaimed a $2T market cap while we were recording, surpassing Google to become the 6th largest asset in the world.

Still think it’s just a trade?

Joined by Robert Breedlove and Bram Kanstein, we explored what this moment really means—not just for the asset, but for the systems it challenges. From sovereign game theory and institutional FOMO to AI-driven deflation, local governance, and the growing divide between exposure and ownership, this episode is about what’s changing—and what’s coming.

Bitcoin Hits $100K (Again): Marker of Maturity, Not Mania

Bitcoin breaking $100K (again) wasn’t a speculative climax—it was quiet validation that years of infrastructure and education are finally compounding.

There’s no retail frenzy this time around. Institutional capital and global liquidity are driving the run—not animal spirits.

ETFs have absorbed most of the new demand—but buyers are owning an IOU, not the asset itself – IBIT surpasses GLD in YTD inflows.

Bitcoin surpassed Google in market cap this week—just as Google saw its first-ever YoY drop in search volume – making it the 6th largest asset and right behind Amazon.

The next psychological milestone? Flipping gold. That would require an ~11x from here.

The Great Awakening: Bitcoin as a Mirror

COVID shattered trust in legacy institutions—accelerating the rise of peer-to-peer trust systems. Bitcoin is the monetary layer of that shift.

Its simplicity—fixed supply, rules without rulers—exposes the complexity and obfuscation baked into fiat systems.

“Bitcoin radically changes the world simply by being unchangeable.”

Opting into Bitcoin often leads to opting out of legacy systems—from seed oils and fiat nutrition to Wall Street and fiat finance.

As Breedlove and Bram note, this isn’t just a financial awakening—it’s a civilizational one.

State & Institutional Adoption: Trojan Horses and Balance Sheets

New Hampshire was the first state to pass a Strategic Bitcoin Reserve bill, 81 years after Bretton Woods — history rhyming as the global monetary order shifts.

Arizona reversed an initial veto to pass its own bill. Texas could be next. Game theory among states is now in motion.

Institutions aren’t adopting Bitcoin because they understand it—they’re adopting because they can’t afford not to, debts and obligations are insurmountable without Bitcoin.

Breedlove calls it a Trojan horse: once constituents benefit and the upside is visible, it’s politically impossible to walk back.

State and nation-state adoption could become a forcing function—reshaping local governance and delivering better lives for citizens.

The Diversification Illusion: Why Savers Are Trapped

Most people don’t want to be investors—they’re forced into investments just to survive fiat debasement.

Over 96% of public companies underperform T-bills. Only a tiny few drive meaningful returns. The S&P is more concentrated than ever—tech mega-caps now drive nearly all index performance.

Bitcoin, by contrast, doesn’t carry CEO risk, regulatory overhangs, or earnings gimmicks—it’s a savings technology, not a stock.

“Bitcoin is a get-rich-slow scheme dressed up as a get-rich-quick scheme.” That disguise keeps most people away—until it doesn’t.

AI, Deflation & the Next Adoption Curve

AI is collapsing production costs—but fiat systems siphon those gains through inflation and policy distortion.

Bitcoin flips the model: in a Bitcoin world, deflation is a feature, not a failure. It benefits savers, not speculators.

Holding Bitcoin is like owning a non-counterparty index on global productivity—without the dilution, CEO risk, or counterparty games.

As productivity accelerates and Bitcoiners grow wealthier, imitation spreads. AI becomes a tailwind for Bitcoin adoption.

Breedlove: “If you’re not saving in Bitcoin, you’re betting against technology—and yourself.”

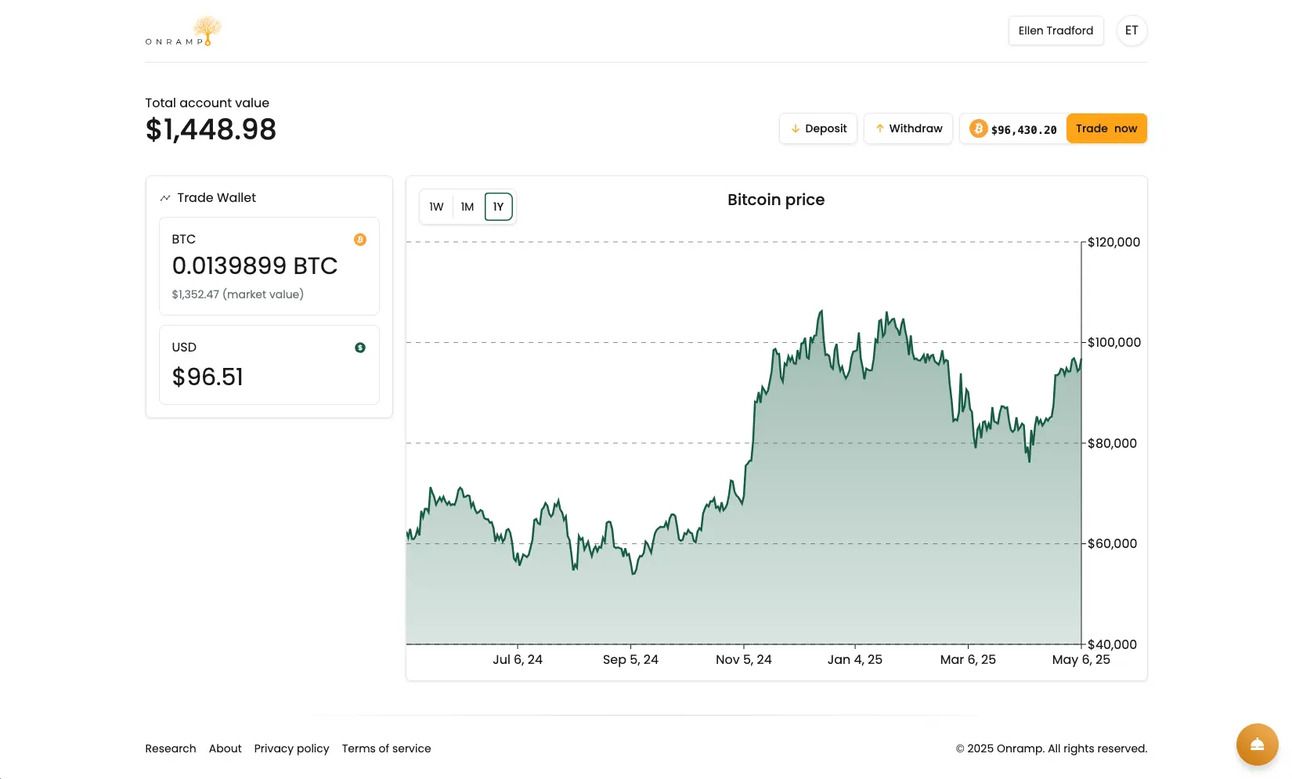

Onramp Client Dashboard - Set up an account & buy Bitcoin in minutes.

Onramp Trade launched this week.

A new account tier built to support clients from initial accumulation to long-term wealth stewardship.

As a reader of The Last Trade, use code TLT to unlock exclusive launch benefits:

Launch Promotions (Sign up by June 30):

🔸 Zero trading fees through September

🔸 50% off account fees ($25/month) through September

🔸 BTC referral rewards: $50 for Onramp Trade, $150 for MIC Vaults

At Onramp, we’re building the infrastructure for serious Bitcoin investors—secure, comprehensive, and purpose-built for long-term strategy.