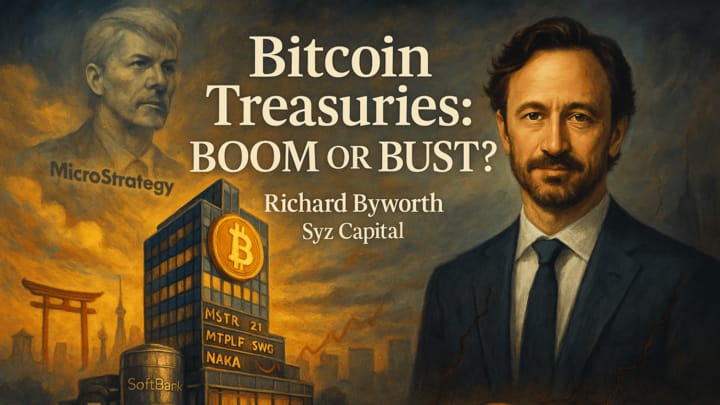

This week’s episode features Rich Byworth (Syz Capital) and Bram Kanstein (Bitcoin for Millennials) for a high-level discussion on the maturing Bitcoin treasury market.

We explored the explosive rise of Bitcoin-denominated venture funds, public market strategies, and the philosophical and structural tensions behind using Bitcoin as the benchmark for value creation.

The conversation also covered major regulatory and institutional milestones, including U.S. policy shifts around Bitcoin infrastructure and new mortgage guidelines that may allow Bitcoin and crypto to be counted as assets when qualifying for single-family home loans.

We concluded with a brief examination of Bitcoin’s current price action, our current position relative to past cycles, and our expectations for the second half of the year.d policy decisions made today will determine whether that lead is preserved or lost.

Bitcoin as the Hurdle Rate

We discussed the theme of Bitcoin as the benchmark or hurdle rate for measuring performance in both venture capital and personal finance.

Denominating a fund in Bitcoin makes performance fees contingent on truly outperforming Bitcoin, which is rarely the case when measuring Bitcoin VC returns against dollar terms.

The concept reframes opportunity cost: whether you're building a company, allocating capital, or making life decisions, you’re constantly asking, “Will this outperform Bitcoin?”

While some view the framing as gimmicky or marketing-driven, particularly in the Bitcoin treasury space, supporters argue that it demands real execution, forcing companies to back up the narrative with a disciplined capital strategy and clear BTC outperformance.

Rich emphasizes that a BTC-denominated fund communicates integrity, investors know the manager must truly outperform the hardest asset to earn carry.

Rise of Bitcoin Treasury Companies

We explored the explosive growth of Bitcoin treasury companies and the capital market dynamics surrounding them. These firms are increasingly viewed as release valves for overvalued traditional markets, but not without controversy.

Bitcoin treasury companies can act as a release valve for overvalued markets: capital trapped in overpriced equities or underpaying bonds can rotate into public equities that hold BTC and exhibit more substantial return potential.

Key appeal to capital allocators: Bitcoin offers the real return (CAGR) that traditional assets fail to match in a world of persistent monetary debasement, and treasury companies create access that otherwise might not exist.

mNAV (market cap vs. net Bitcoin holdings) has become the dominant valuation lens; smaller firms can exhibit extreme Bitcoin accretion and “torque,” while larger firms struggle to replicate that growth.

Michael and Brian highlight the retail-first marketing playbook, Bitcoin influencers, meme stocks, and community hype, raising concerns over whether this is a durable institutional phenomenon or just the latest trade.

While some view these firms as speculative trades or short-term bets, Rich argues that they represent Bitcoin’s institutional adoption in real-time, providing a “peaceful transition” mechanism for legacy capital to move into sound money.

Custody, Risk, and Governance Gaps

The group unpacked a critical yet often overlooked topic: how Bitcoin treasury companies manage custody, counterparty risk, and corporate governance, especially as they scale.

Rich emphasized that many of these firms are listed on lightly regulated exchanges (like AQUIS in the UK), which lack the strict oversight of higher-tier markets.

The core risk isn’t necessarily leverage; it’s custody. Most investors assume that best-in-class custody standards are in place, but very few firms disclose how their Bitcoin is secured.

Due diligence checklists should include trust in management, transparent security infrastructure, and clear Bitcoin acquisition logic, which should be mandatory for allocators.

Without stronger standards, a single custody failure could undermine the broader narrative around Bitcoin public equities and hinder institutional adoption.

Bitcoin and the Mortgage System: Institutional Recognition, Real-World Tradeoffs

As Bitcoin continues to gain legitimacy in U.S. financial policy, new guidelines are beginning to reshape how lenders assess wealth and risk.

Bill Pulte, Chairman of Fannie Mae and Freddie Mac, issued guidance allowing Bitcoin and crypto assets to be included as part of borrower wealth in single-family home loan evaluations.

The policy is symbolically important but could be practically limited, since many Bitcoiners already seek ways to avoid selling BTC to fund real estate purchases, the group had varying opinions here..

A key caveat is that the assets must be held on a centralized exchange, which creates friction for self-custody users and introduces the risk of future asset freezes or transaction monitoring.

The broader theme remains: Bitcoin is becoming more legible to institutions, but that comes with tradeoffs in privacy, custody, and control.

Bitcoin Price Action and Market Psychology

We reflected on Bitcoin’s current price behavior post-halving dynamics and what the second half of 2025 might look like. The conversation also explored investor psychology long-term conviction, and why consolidation may be a gift in disguise.

Despite record demand from ETFs and treasury companies, Bitcoin has remained range-bound near $100k, leading some to question whether this cycle is following historical patterns.

The current price represents a significant discount to Bitcoin’s expected monetary value, achieving Gold’s market cap would imply a price over $1 million

Long-term holders with low cost basis have been steadily selling, while many institutional allocators are still at the early stages of understanding Bitcoin.

Is the treasury stock excitement echoing the ICO era, with investors tempted to chase returns even as holding Bitcoin may be the clearest path to long-term wealth?

The longer this consolidation lasts, the more BTC concentrates in the hands of high-conviction holders, setting the stage for the next major phase of adoption.

Whether you’re making an initial allocation or already have a significant position, Onramp helps you protect and grow your Bitcoin with institutional-grade custody, seamless inheritance planning, and access to trusted financial services.

Private client experience. Multi-institution security. Total peace of mind.

Onramp — Where Security Meets Simplicity.